Alternative Data and AI Trends in 2026

Adrian Krebs,Co-Founder & CEO of Kadoa

Adrian Krebs,Co-Founder & CEO of KadoaAfter conducting year-end reviews with data teams, analysts, and PMs, one thing is clear: the industry is moving from AI experimentation to full-scale adoption. AI is at the top of most management agendas as funds want to better leverage internal and external data to make their investment research more efficient.

As AI projects move from pilot to production, the focus has shifted towards data centralization, making data more accessible to both humans and agents, and ensuring reliability and compliance at scale.

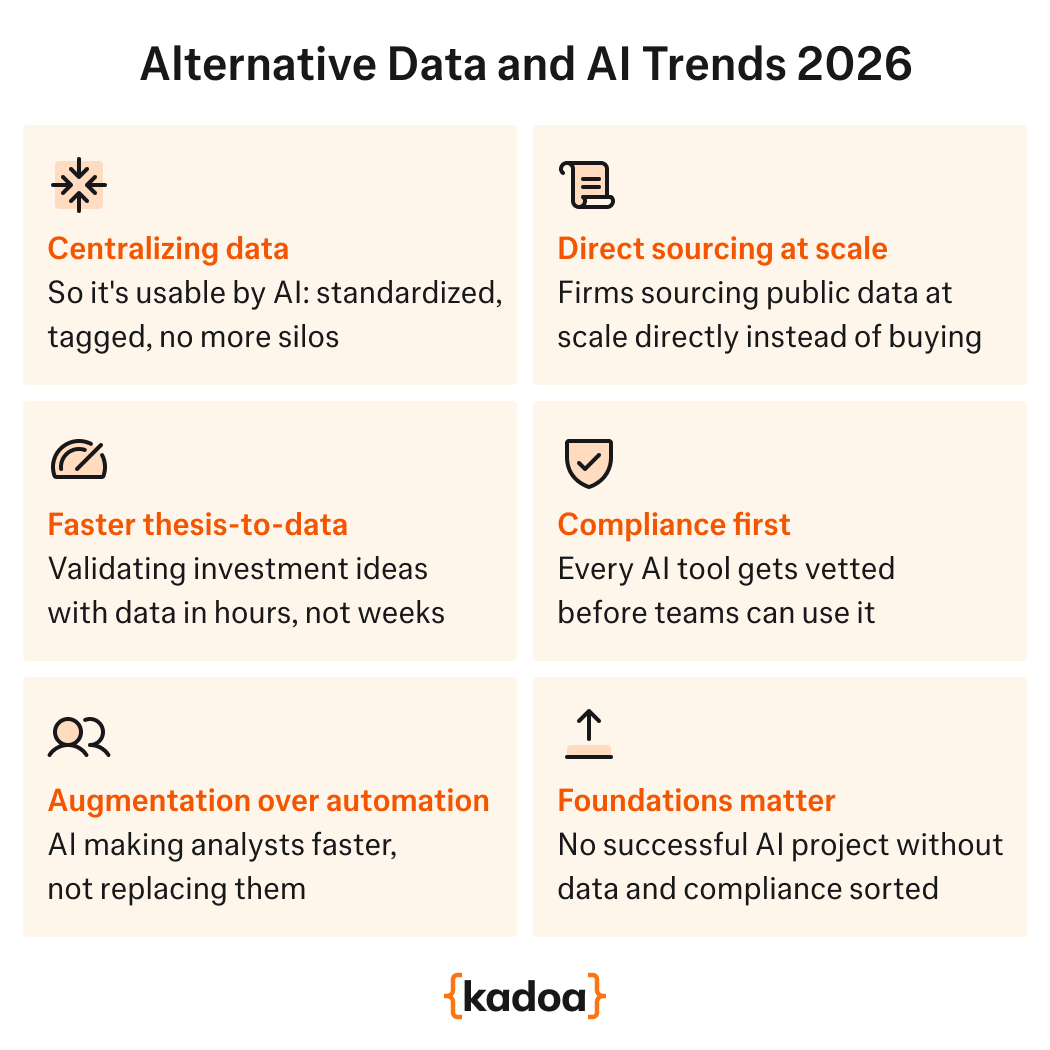

Here is what’s top of mind for alternative data and AI heading into 2026:

1. Data Centralization as a Foundation

Siloed data is a core challenge for many firms and a key goal across firms is to get to a centralized database/data warehouse where various types of data (public, vendor, market, alternative) is ingested in a standardized way.

All with the goal of making data more accessible to both analysts and LLMs.

Different datasets become far more valuable when you can join them together, and AI can help a lot in standardizing, cleaning, or tagging messy data from various sources.

The centralization leads to less redundancy across the firm, less manual copy-pasting from vendor portals and public filings, and faster access for analysts who previously had to gather data across systems.

This is the foundation to then leverage internal ChatGPT-like tools, which most firms are using by now. But it's the garbage in, garbage out problem we know well.

2. Direct Data Sourcing at Scale

For years, you either bought alternative datasets off the shelf from data providers or went without. Direct in-house sourcing of public data through scraping or document parsing was possible but usually only something the big funds and engineering teams were able to afford.

That's starting to change as data teams can now do more with less. Technology for direct sourcing from public websites, filings, and PDFs has gotten good and cheap enough (mainly thanks to LLMs) that in-house teams are seriously evaluating it. They won't replace vendors entirely, but they will start to cover blind spots and reduce dependency.

This puts pressure on data providers. If the sourcing and aggregation can be commoditized, the value has to come from somewhere else: proprietary methodology, unique access, or processed signals. Simply curating public data may no longer be enough.

3. Faster Thesis-to-Data

When a portfolio manager has an investment thesis, the bottleneck has always been data. Getting the right information to validate and de-risk an idea used to mean requests to the data team and days of waiting.

That feedback loop is becoming much faster. PMs can now check risk exposure, pull in supporting data, and fill blind spots in hours rather than weeks. The result: faster decisions and more confidence behind them.

Self-service tooling is an enabler here. AI makes it possible that non-technical users can query and explore data directly, which means fewer handoffs and less friction between idea and execution.

4. Compliance First, Always

Every team wants to try the latest AI tools and compliance is getting swamped with vendor onboardings and DDQs.

The concern is real. You want to avoid the scenario where an investment team starts working with a vendor, and compliance later discovers it's some dubious data sourcing firm with questionable origins. At many funds, compliance now vets everything before investment teams can touch it.

This creates a real barrier for data vendors and platforms. Those with compliance certifications, built-in compliance controls and audit trails, and good documentation can get approval faster.

5. Augmentation over Automation

There's a useful distinction in how firms think about AI: augmentation versus automation. Anthropic's Economic Index found that 57% of usage augments human capabilities (learning, iterating, refining) while 43% automates tasks with minimal human involvement.

Source: Anthropic Economic Index

Source: Anthropic Economic Index

In finance, augmentation is also winning. The most successful AI pilots are making analysts more efficient, not replacing them. Summarization, sentiment analysis, data extraction, and dynamic visualizations help investment teams get to high-conviction decisions faster.

Could agents eventually execute trades autonomously, with portfolio managers providing oversight?

We're not there yet. LLM-based trading agents still hallucinate and fail in ways that would cause catastrophic losses. But as systems and guardrails get better and better, the human role will likely shift from execution to oversight.

Conclusion

Alternative data and AI go hand-in-hand. Garbage in, garbage out. AI for investment research relies on centralized, well-structured, and tagged datasets that can then be joined together and made accessible to users.

As the industry transitions from hype to adoption, it becomes clear that the winners won't be firms with the most datasets or the fanciest AI tools. They'll be the ones who got the foundations right: centralized data, compliant workflows, and AI that reliably augments rather than trying to replace human judgment.

Adrian is the Co-Founder and CEO of Kadoa. He has a background in software engineering and AI, and is passionate about building tools that make data extraction accessible to everyone.

Related Articles

From Scrapers to Agents: How AI Is Changing Web Scraping

We spoke with Dan Entrup about how web scraping in finance hasn't evolved much in 20+ years and how AI is changing that now.

Track U.S. President and White House News in Real-Time

We built an AI-powered tracker that monitors U.S. presidential and White House news faster than mainstream channels.

AI, Automation, and Alpha: Alternative Data Trends 2025

We explore the key alternative data trends for 2025